michigan sales tax exemption rolling stock

A The product of the out-of-state usage. 111 I Qualified Data Center 12 I Direct Pay - Authorized to pay use tax on qualified transactions.

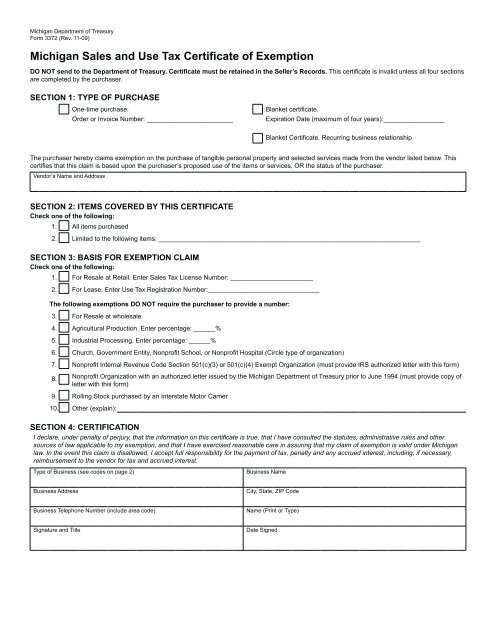

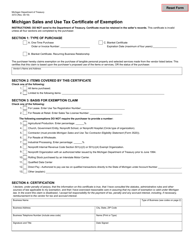

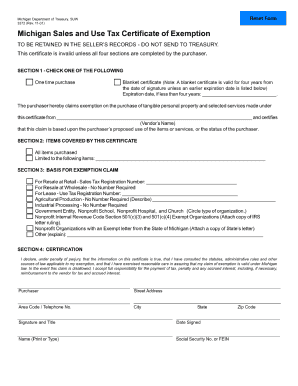

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Direct Pay - Authorized to pay use tax on qualified transactions directly to the State of Michigan under.

. 5567 amended the General Sales Tax Act to provide a partial sales tax exemption for sales of qualified trucks and trailers for taxes levied after December 31 1996 and before May 1 1999. Check one of the following. While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

Rolling Stock purchased by an Interstate Motor Carrier. For other Michigan sales tax exemption certificates go here. Definitions 1 All of the following are exempt from the tax under this act.

Interstate fleet motor carriers who qualify for exemption may claim exemption from sales or use tax by providing the seller or lessor with the prescribed Michigan Sales and Use Tax Certificate. This page discusses various sales tax exemptions in Michigan. Expand rolling stock sales tax exemption.

Nonprofit Organization with an authorized letter issued by the Michigan Department of Treasury prior to June 1994. Michigan Laws Bills and Votes using concise plain and objective descriptions. If you are looking to purchase goods in Michigan and you have tax-exempt status you need to fill out this form and present it to the.

Section 20554r - Qualified truck trailer or rolling stock. Includes an activity engaged in by a person or caused to be engaged in by that person with the object of gain benefit or advantage either. Up to 2 cash back 10 I Rolling Stock purchased by an Interstate Motor Carrier.

Terms Used In Michigan Laws 20554r. Shanelle Jackson D-Detroit has taken the lead in pursuing legislation that would call on Michigan truckers to pay even more taxes to the state. Senate Bill 544 S-1 would amend the General Sales Tax Act to exempt from the tax sales of rolling stock purchased by an interstate motor carrier and used in interstate commerce.

Her first bill would once. Qualified Data Center 12. Enter Use Tax Registration Number.

Mi Sales Tax Exemption Form Animart

Michigan Sales And Use Tax Certificate Of Exemption

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Tax Exemptions Live Auctions Miedema Auctioneering Michigan

Valley Slate Pool Table With Coin Mech And Keys Spencer Sales

Why Is There Sales Tax On Money Numismatic News

Online Sales Tax Tips For Ecommerce 2022

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

News Fort Wayne Railroad Historical Society

Mi Sales Tax Exemption Form Animart

Tangible Personal Property State Tangible Personal Property Taxes

Tax Exemptions Live Auctions Miedema Auctioneering Michigan

Exemptions From The Michigan Sales Tax

Irs Form 3372 Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax Small Business Guide Truic

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller